If you’re considering entering the world of forex trading, **Exness** is a platform you might want to explore. The exness forex minimum deposit Exness CFD broker is well-regarded for its user-friendly interface and competitive conditions. However, before jumping in, it’s essential to understand the minimum deposit requirements, as they can significantly impact your trading strategy and experience.

What is Forex Trading?

Forex trading, or foreign exchange trading, involves buying and selling currency pairs in the hope of making a profit. It is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Traders can leverage fluctuations in exchange rates, making it an enticing opportunity for those looking to invest.

The Role of Minimum Deposit in Forex Trading

The minimum deposit is the least amount of money that a trader must deposit to open an account with a forex broker. This deposit allows the trader to start trading currencies and can vary from broker to broker. Understanding the minimum deposit in the context of Exness can help you determine if the platform aligns with your trading goals and budget.

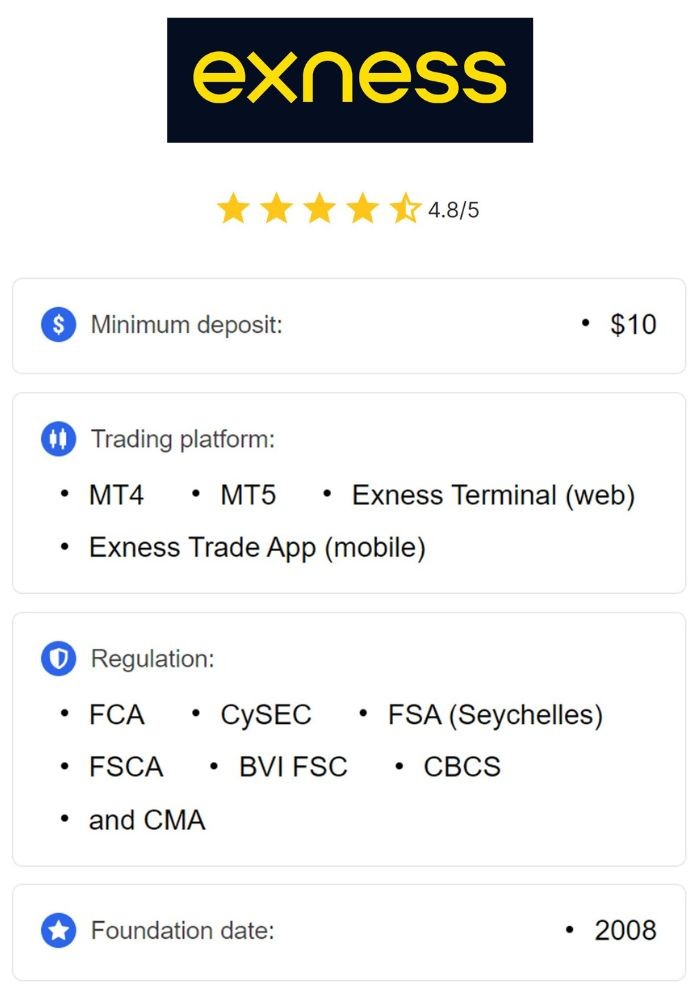

Exness Forex Minimum Deposit

Exness is known for its flexible policies regarding deposits. As of this writing, the **minimum deposit** amount for opening a live trading account with Exness can be as low as $1, making it an attractive option for new traders who may not want to risk significant capital at the beginning. This low entry barrier allows individuals to test the waters of forex trading without making a substantial financial commitment.

Types of Accounts and Their Minimum Deposits

Exness offers several types of trading accounts, each catering to different styles and preferences. Here’s a brief overview:

- Standard Account: The minimum deposit is just $1, providing access to a plethora of trading instruments, along with user-friendly trading tools.

- Pro Account: This account type also has a minimum deposit of $200, offering tighter spreads and more advanced trading conditions, particularly attractive to more serious traders.

- Zero Account: With a minimum deposit of $500, this account features zero spreads but may charge a small commission on trades, making it suitable for frequent traders.

Depositing Funds into Your Exness Account

Once you’ve chosen an account type and prepared your minimum deposit, the next step is to transfer funds into your Exness account. Exness provides a variety of payment methods to facilitate easy deposits, including:

- Bank transfers

- Credit and debit cards

- Digital wallets like Skrill, Neteller, and WebMoney

The processing times for these deposits can be instantaneous or may take a few hours, depending on the chosen method. Exness aims to facilitate a seamless experience for its traders, and this diversity in payment options underscores its commitment to user convenience.

Benefits of a Low Minimum Deposit

The low minimum deposit requirement at Exness serves several purposes:

- Accessibility: New traders can enter the market without needing a large capital base, making forex trading more accessible to a wider audience.

- Risk Management: A low entry point allows traders to manage their risk better and experiment without fear of losing significant amounts of money.

- Learning Opportunities: With minimal financial commitment, traders can focus on learning and refining their skills without the pressure of substantial financial loss.

Tools and Resources for New Traders

For new traders on the Exness platform, the company offers various educational resources and trading tools to ease the learning process:

- Webinars and Tutorials: Exness provides free webinars and video tutorials on fundamental and technical analysis, helping traders to understand the market.

- Trading Signals: The platform offers trading signals that can assist in decision-making, particularly crucial for novice traders.

- Demo Accounts: Exness allows users to open demo accounts with virtual funds, allowing them to practice trading in a risk-free environment before committing real money.

Conclusion

Understanding the Exness forex minimum deposit is crucial for anyone considering entering the forex market. With its low barrier to entry and diverse account options, Exness creates an opportunity for both novice and experienced traders to engage in forex trading effectively. By leveraging the available tools and resources, new traders can develop their skills and work towards becoming proficient in this complex and challenging market. Remember, trading always involves risks, and it is essential to trade responsibly and within your means.

Read More